Steel Industry Must Shift To Coal Gasification And Turn Energy-Efficient To Match Centre's Push For Green Steel

The industry is in an expansion mode to build a manufacturing capacity of 300 MnTPA by 2030

Steel Industry Must Shift To Coal Gasification And Turn Energy-Efficient To Match Centre's Push For Green Steel

The Directorate General of Trade Remedies (DGTR), under the Union Commerce Ministry, has initiated a probe into the alleged increase in imports of certain steel flat products following a complaint from the apex industry body ISA

Hit hard by surging imports, the Indian steel industry will be keenly eyeing policy initiatives in 2025 to safeguard its interests as it moves ahead with the 300 MnT capacity target amid volatile raw material prices. Another challenge they face will be to expedite efforts to transition to clean manufacturing processes with the government's push to green steel production amid global thrust on cutting greenhouse gas emissions in hard-to-abate sectors.

The government intervention will be essential as the industry is in an expansion mode to build a manufacturing capacity of 300 MnTPA by 2030 or which it needs investments worth around Rs. 10 lakh crore to add the remaining 120 MnT capacity to achieve the target.

According to the Ministry of Steel, India remained a net importer of steel, with imports in April-September FY25 outpacing exports by a wide margin. Its imports rose over 41 per cent to 4.70 million tonnes (MnT) from 3.33 MnT in the six-month period of the last fiscal.

Exports came down by 36 per cent to 2.31 MnT from 3.60 MnT in April-September FY24, official data showed.

On imports, the ministry said that there is a growing demand by the industry for protection against cheap imports from China directly or through countries like Vietnam, among others. The global trend also reflects heightened efforts to safeguard domestic industries.

The EU has already imposed anti-dumping duties on cold and hot rolled stainless steel, while Brazil, Mexico and the US have also implemented duties to protect their domestic markets, it added.

In a December 2 meeting with the commerce department, the steel ministry proposed a 25 per cent safeguard duty on certain steel products imported into the country. The meeting was attended by the Steel Minister HD Kumaraswamy and Commerce and Industry Minister Piyush Goyal.

The Directorate General of Trade Remedies (DGTR), under the Commerce Ministry, has also initiated a probe into the alleged increase in imports of certain steel flat products into the country following a complaint from the apex industry body Indian Steel Association (ISA), whose members include Tata Steel, JSW Steel, AMNS India, Jindal Steel and Power and state-owned Steel Authority of India Ltd (SAIL). Industry members said that out of the total imports of 5.7 MT of steel during April-November, about 79 per cent came from China, Japan and Korea alone. The direct impact of increased imports has been the substantial decrease in the prices of steel products, particularly in the flat segment, where capacity expansion has been rampant in the recent past, in addition to the increase in inventories, they added. Despite headwinds, the industry made some progress, which it looks to continue in 2025.

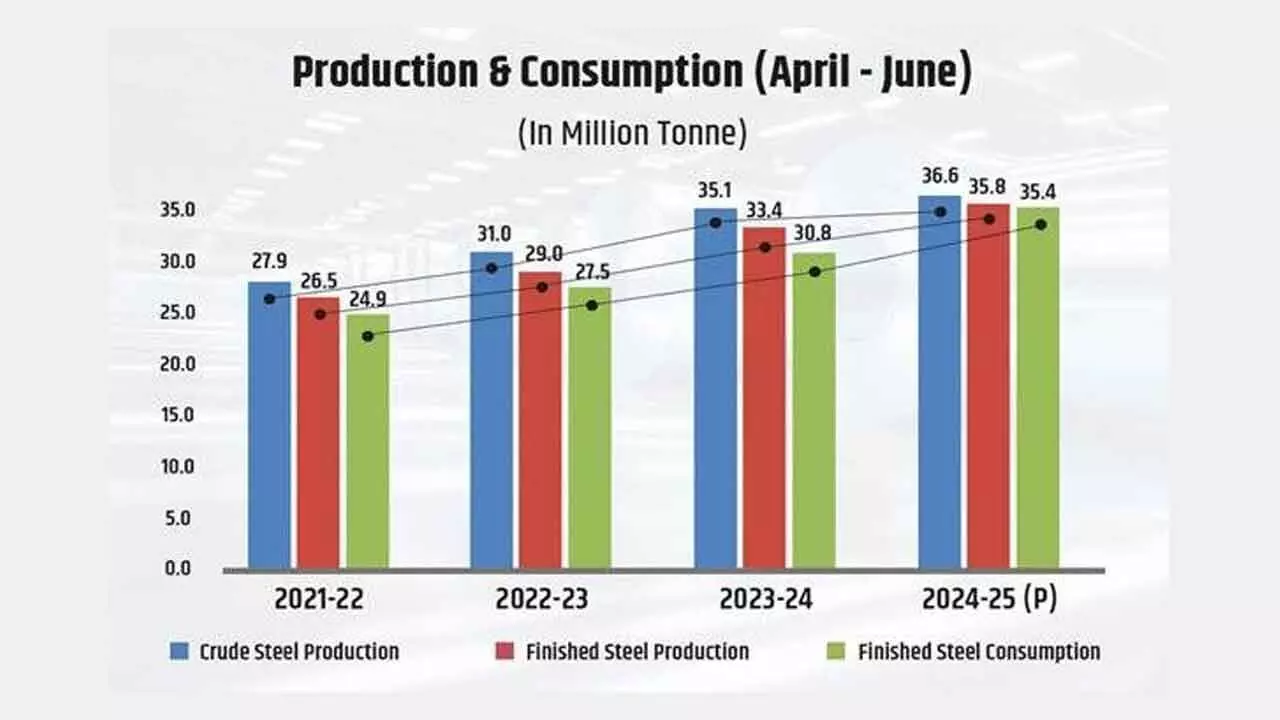

In 2024, India's crude steel capacity is estimated to be 180 MnT, up from 164 MnT in 2023. The production is expected to be 146 MnT in 2024, higher than 130 MnT in 2023. Consumption is likely to be 145 MnT over the 140 MnT figure in 2023.

In 2025, the industry expects capacity to be 195 MnT, production 158 MnT and consumption 155 MnT. The sector expects policy support for the production and import of raw materials, including fiscal incentives, as it suffered in the market due to lower steel prices against high input costs in 2024. Coking coal, which was at $200/tonne at the end of Q2 (Jul-Sep FY25) surged to $225/tonne in December, and iron ore, which cost $90/tonne, touched a level of $100/tonne, markets research firm BigMint said.

Meanwhile, hot rolled coil (HRC) prices continued to fall from Rs. 48,000/tonne at the end of Q2 to Rs. 47,000/tonne in December, the month in which the Centre introduced the taxonomy for green steel to promote clean practices and the use of alternate raw materials. This is expected to give domestic players an edge in view of the European Union's proposed anti-emission measure CBAM, which discourages imports of steel produced through non-sustainable procedures.

Steel producers need to hasten the process of decarbonisation as most of the steel produced will not be able to qualify for even a three-star category with minimum Co2 emissions of 2.2 tonne/finished steel, PHDCCI Chair, Minerals and Metals Committee, Anil Chaudhary said.

Following the government's push to green steel, the industry will have to improve its energy efficiency, reduce blast furnace emissions through alternative fuels and carbon capture, utilisation and storage (CCUS), and shift to cleaner gas-based methods via coal gasification, Dastur Energy CEO and President Atanu Mukherjee said.

Meanwhile, CII said that the current roadmap and adoption of green steel in the country has been slow, posing a hurdle for future development. Sharing the outlook for the sector in 2025, Ritabrata Ghosh, Vice-president and Sector Head - Corporate Ratings, Icra, said that the industry's capacity utilisation is slated to slip below 80 per cent after a gap of four years.

The stainless steel industry has said that in 2025 it expects the government to launch a separate policy for the sector, which has different concerns. Synergy Steels Director Anubhav Kathuria said, "A policy for stainless steel will be essential to realising maximum capacity utilisation, moving above current levels of 60 per cent and contributing to economic and industrial development over the long term".

The industry will prioritise driving demand for stainless steel in sustainable urban development, water infrastructure, and smart city projects in 2025, said Indian Stainless Steel Development Association (ISSDA) President Rajamani Krishnamurti.